The post The Forbidden Cave appeared first on The Perry Bible Fellowship.

Click here to go see the bonus panel!

Hovertext:

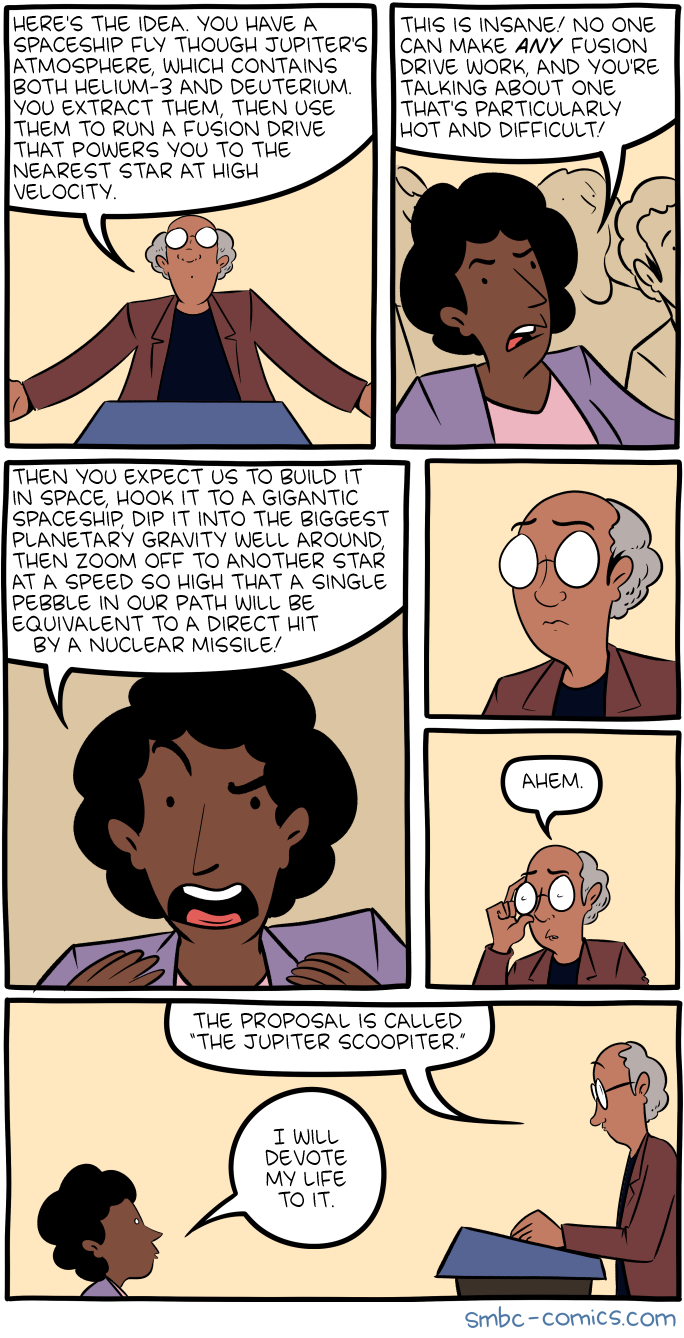

This is an actual proposal I came across while researching for a project.

Today's News:

Pssst. Hey, dorks of London. Want to see the world's nerdiest comedy night ever?

The First Presidency of The Church of Jesus Christ of Latter-day Saints has announced that the groundbreaking for the first temple in Puerto Rico will be held Saturday, May 4, 2019. Elder Walter F. González, president of the Caribbean Area, for the Church will preside.

Something I’ve been thinking about a lot lately is how for all the (terrible) posting I do online, I still consider myself a relatively private person. Knowing where I went to high school and when I graduated isn’t going to help you figure out my passwords or security question answers anyway, but I don’t mean that kind of privacy. Specifically, I avoid sharing anything that I feel could be weaponized against me and/or my family. Things like my hopes and dreams, my kids’ faces and names, the ins and outs of my relationships with friends and family. Which means I think you’ll find all of one annual introspection post from me from several years ago – I love reading them from other people and celebrating their accomplishments with them across the internet, but I generally don’t share back.

2018 was a big year for me though, and really what I’m doing right now is writing a post so that I can unpack it all for myself before deciding whether I’m comfortable sharing about it. Here we go.

The Move

The absolute biggest thing that happened this year was that we moved to my husband’s home country: Costa Rica. We did this primarily for our kids, but also generally for a better quality of life. I could elaborate on a hundred different things that I feel like are better, but, you know, private. What I will say is this: we were here early in the year and watching my children blossom as they enjoyed the outdoors and their grandparents and aunts and uncles brought actual tears to my eyes, and then we flew back home to snow in March and a renewed feeling of my own home country not seeing me as an equal citizen. So I said, what’s keeping us here? And the answer was: nothing, really.

One thing I do want to acknowledge is how defensive I feel when people react to this news with “oh wow, tropical/beach/paradise life!” Costa Rica is beautiful with incredibly kind people and I love that, don’t get me wrong. But I didn’t come here to live an American lifestyle and do that (ugh) ex-pat thing, a term I hate for its roots in classism. We live in a nice suburb of the capital city in a microclimate with year-round temperatures of 75-80ºF during the day, 60-65ºF at night – it’s hours from the beach and we are largely in the same routine as always, especially with the kids. My oldest goes to a school nearby with the regular Costa Rican school schedule, not one of the American schools with a US school year and course offerings.

My feeling is much more in line with the story of my parents: immigrants to another country, attempting to assimilate to suburban life, figuring out social and class structures and how to integrate yourselves and your children. I have it much easier than my parents – extended family nearby (under the same roof, even), 15 years of exposure to Costa Ricans, decent language skills, and a significant economic advantage. But I do miss out on having a Chinese/Asian American community, whereas my parents landed in places with sizable peer groups. That part has started to weigh on me a little and I’ve begun to seek out other Asian Americans in the area, as the significant Chinese immigrant population is not immediately relatable from a cultural standpoint, but overall as a person who works from home in the first place and gets to enjoy the happiness of her children all throughout the day, I am confident we made the right choice.

Back to Music

For those of you who don’t already know, I’m also a pianist, with both my undergrad and master’s degrees in music. For my first three years as a full-time web developer, I was also a church+choir+freelance pianist (and still lived in low-income housing, if that tells you anything about university pay). After moving to 10up, our rapid early growth and then my first child really pushed music-making to occasional hobby status instead of integral part of my life (full disclosure: I was never a daily practicer, even in conservatory). In 2017 I vowed to push myself to finally perform one of my holy grail pieces – the Brahms piano quintet – and in 2018 I did it! Shout out to my pal Will Davis for hooking me up with his string quartet of people with similar backgrounds – wandered into tech/startups after serious music school study.

In 2019 I vow to finally replace the audio of our YouTube live streamed performance with the recording off a device with the proper gain set and get that out there. I have also started playing with my husband again after several years of him focusing more on duo work with his brother. We plan on playing a couple of recitals here in Costa Rica over the first half of the year before heading to Guatemala in June for a clarinet fest where we will present a polished program.

Personal Fulfillment

I don’t really consider music a hobby because it was my profession for a long time and because (ego alert) I’m a significantly better pianist than “hobby” implies. So outside of that, I have two main hobbies: cooking/baking and shoes. My goal has been to scale up the former while scaling back the latter – though, to be fair to myself, I do not actually buy shoes that often, I just post pictures in spurts that make it look like I’ve acquired everything all at once. I think I’ve mostly accomplished this and plan to continue the trend in 2019.

For cooking and baking, there are two major areas that I would like to continue to focus on: Chinese food and bread. It’s a little more complicated here because of availability and cost of specialty ingredients, especially after being spoiled by living a mile away from an Asian Food Market. Toward the end of the year I found tipo 00 tenero flour at Walmart of all places and brought back my copy of Bread Illustrated, so I really dove in and made some very successful pizza dough, foccacia, and dinner rolls. I also attempted my first ever dumpling wrappers, which I think were only mediocre. I’ll be doing more trials of that soon.

Shoe-wise… well. I wrote out a bunch of details but then decided I didn’t feel like wading that far in. In any case, one of the things that’s been really good for me moving to Costa Rica is somewhat less availability of material goods. That’s not to say you can’t find anything – for instance as a US point of reference, there’s a Crate and Barrel in the upscale town where the prices are basically the same as the US, just with the sales tax of 15% already included in the tagged prices. But there isn’t Amazon Prime, no constant sale marketing, no resale culture (for a lot of reasons including a lack of a reliable postal system, I hope people truly appreciate the USPS because it’s amazing), and generally lower stock where you have to be able to decide if you want a thing right there and then. I mean, it’s an entire country of about 5 million people where we just moved from a metro area that’s estimated at almost 24 million as of 5 years ago, so of course the scale is different.

As much as I enjoy my bit of vanity, the reality is that I work from home and I want to generally be more mindful of how much nonsense we buy and therefore blow our budget on. So far we are still blowing money fast (B.M.F., per Rick Ross) because of the complications of partial moving and having a house that’s twice as large as our last, but I expect that to even out in 2019 so I can finally realize the financial advantages of our move.

Aside: I went into a diversion about my shift from non-privileged to privileged which I think is a great topic of discussion but is one of those things where I don’t think I’m eloquent enough to describe it in writing and is also easily weaponized, so if we’re pals and you want to hear about it, let’s catch up soon.

Work Changes

The last 2 years of work have not been the usual for me. 2017 was not exactly a productive year on that front – I was battling some burn-out after leading the WordPress 4.7 release through the back half of 2016, my second pregnancy was tough, then I had maternity leave, and then I was “ramping back up”. I’m still at 10up (8 years this year! Oh yeah and we’re always hiring) and don’t have any desire to go anywhere else, but I needed a change.

We started 2018 out by doing what I seem to keep doing – changing my title. I went from being the Director of Platform Experience (in fairness, this was my title for quite a while) to the Director of Open Source Initiatives – much clearer about the difference between that and our own completely separate hosted platform options, and with an eye toward continuing to grow our broader open source efforts and not just think about the core WordPress software all the time. In that vein, we spun up an Open Source Practice team. I felt excited about the direction, but as we got into the daily rhythm it still didn’t quite suit me and honestly, I’m just tired.

So I finally did what I’ve thought about doing time and time again: I moved to being part-time. I always talk about how I got into web dev for benefits and a steady paycheck in a joking way but I’m actually quite serious – I was just lucky that I could find a thing I liked well enough in pursuit of stability and ended up finding a niche to excel in. I hadn’t made the change previously because I was so afraid of what it would mean for my benefits and I couldn’t fathom bringing home less as the primary earner with two kids in the NYC metro. But 10up remained as supportive as ever, and nothing actually changed on the HR front – benefits and base salary have remained as they were. I make somewhat less because of the way my total comp was previously structured, but moving has made that a non-issue. I see it as a net raise

In WordPress-land, I’ve been largely absent from the core workflow for these past two years, mostly by choice or because I was on leave entirely. I feel guilty about it sometimes, especially with the weight of that “lead developer” title, but I think that’s an important part of open source software development – people come and go, and everything about your processes and structures have to be able to accommodate that. WordPress people might have noticed in the 5.0 release that there’s no longer a section of “project leaders” on the about page. It did kind of sting for a moment, not because I felt upset or demoted, but because it reminded me of just how far I’ve drifted from what once motivated almost the entirety of my work. I have more thoughts about project leadership, as do a lot of other people it seems, but that’s better saved for another time and place.

2019 is shaping up to be a good one for my work life. We’ve successfully recruited a team+project+product manager for our open source practice who’s amazing and complements my skill set as the director/“thought leader” very well. I think we are going to do some really cool things as a team this year with a better structure and I’m super excited about it. I’ve also started ramping back up into a few WordPress core projects and being more available as a resource for mentorship and advocacy (things I think leads should really excel at) and look forward to staying active in those areas as well.

What else?

I’m currently not trying to do more, nor do I think this post captures all the different things I do day to day. My primary concern is my children, especially because they are both very young and require a lot of active attention, which I do not document on the internet. But I do have some longer-term things I’d like to do, maybe not in 2019, but someday. Like finally opening a bubble tea slash Chinese bakery place as we’ve been talking about for 10 years now. Maybe if I do a 2019 retrospective we will see where we are then!

Last weekend, Kim and I flew to Utah for a reunion with friends from the 2016 chautauqua in Ecuador. While in Salt Lake City, we met up with Jesse Mecham (the founder of You Need a Budget), visited Utah Olympic Park, and attended a Sunday morning performance of the Mormon Tabernacle Choir.

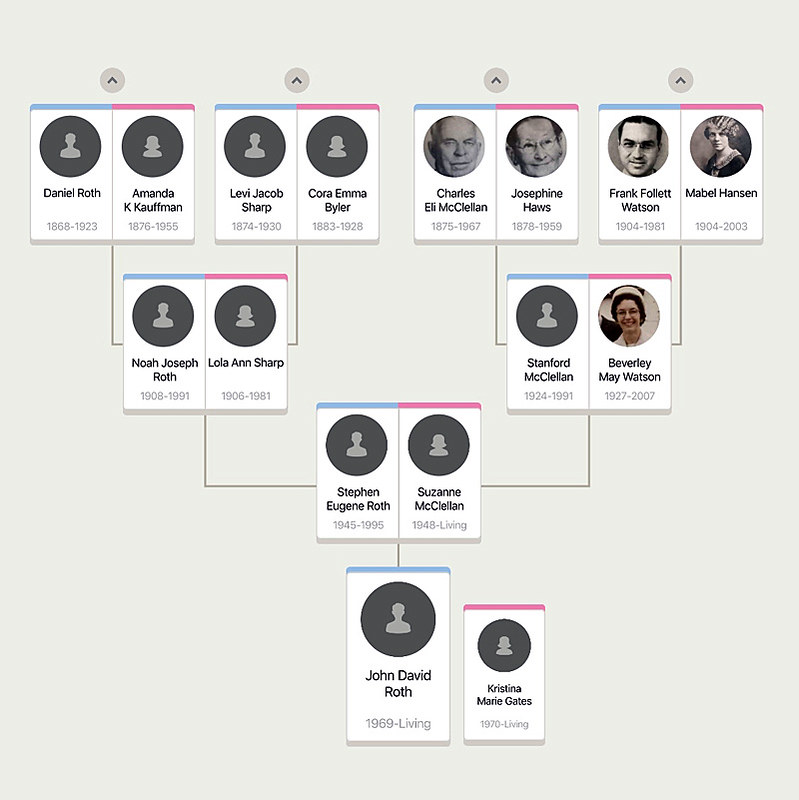

Our group also spent an entire afternoon at the Mormon Family History Library, where we explored our genealogy. Not everyone was enthused about researching their family tree at first, but eventually even those who thought the exercise would be lame found themselves wrapped in it. It's fun — and enlightening — to unravel the threads of time and discover who your ancestors were and where they came from.

Flying home from Salt Lake City, I got to thinking about how our family trees don't just influence our genetics. We inherit more than physical features from those who came before us. We also inherit culture and psychology and values. And yes, we inherit financial habits from our parents and grandparents.

Each of us has a financial family tree.

My Financial Family Tree

I write often about our money blueprints, the set of subconscious “scripts” that define our behaviors and attitudes toward money. Society at large — our friends, co-workers, the mass media — plays a role in writing these scripts, but most of our money blueprints are inherited from our family — especially our parents.

In a way, it's as if our money blueprints are a product of our financial family trees. Our grandparents passed their feelings about money to their children, and these children instilled their habits and attitudes into us.

When I look at my own relationship with money, it's easy to see how my present actions and attitudes — even at nearly fifty years old! — were inherited from my parents.

Here are a few examples:

- My parents raised three boys in an 800-square-foot trailer house. My parents had 800 square feet for the entire family. The Portland condo that Kim and I sold last year was 1600 square feet. She and I had 800 square feet per person. But I don't need a big, fancy house. I'd be happy — might be happier, in fact — hunkered down in a single-wide trailer somewhere on a couple of acres.

- Likewise, I don't need fancy cars. Growing up, I don't think my parents ever had a new car. We had old beaters that went by names like “Dirty Red” and “Dirty White”. Now, as an adult, I'm perfectly content to drive a 15-year-old Mini Cooper. I rarely feel the urge to own a new vehicle.

- I inherited a similar attitude toward clothing. My father dressed like a farmer. My mother did her best to look nice, but on a budget. She bought clothes for us boys off close-out racks and at thrift stores. Although I do put some thought into quality and style nowadays, for most of my life I've been more interested in function not fashion.

Because of my meager origins, I'm willing to tolerate and accept certain things that others won't. I'm never frightened that I might end up poor because I've already been poor and have survived the experience. In some ways, my financial family tree set me up for success.

That said, my financial family tree also set me up for failure. I inherited some destructive habits.

- My father was a master of compulsive spending — especially on big-ticket items that he couldn't truly afford. He bought computers. He bought sailboats. He bought airplanes. He bought stereo equipment. Some of my fondest memories are hanging out with dad for hours while he shopped for something he shouldn't buy. Unsurprisingly, I've struggled with compulsive spending most of my adult life.

- My mother wasn't a compulsive spender in the same way my father was. Instead, she was something of a hoarder. She tended to buy more than we actually needed: more food, more clothes, more household supplies. This tendency became especially pronounced after dad died. When we moved mom to assisted living in 2011, her house house was packed with excess groceries and supplies. From mom, I've inherited a tendency to accumulate too much Stuff.

- My parents never saved. They were always living on their last five dollars. If they had money, they spend it. If they'd had credit cards, they would have maxed them out. When I left home, I too lived paycheck to paycheck, no matter how good my salary was. (And I did get into trouble with credit cards.)

Not all of my money habits came from my parents. Many did, it's true, but I've developed new habits of my own. I've also “inherited” habits from my long-term relationships with Kris and Kim. (Kris and Kim have remarkably similar money habits, by the way.)

Your Financial Family Tree

When I returned from Utah, I emailed family members to ask them what sorts of habits they'd inherited from their parents. My cousin Duane replied:

My dad had a huge impact on my relationship with money. He drilled holes through nickels rather than pay six cents for stainless steel washers. This was extreme and he did it more to be funny, but really illustrates how cheap he was. He strongly influenced my views of money. That's why I'm a cheap bastard.

My dad didn't feel he deserved money. Perhaps because he didn't like it. I have also felt I don't deserve money. I always give things away or sell them too cheaply.

I also asked members of the Get Rich Slowly group on Facebook about their financial family trees.

The answers — both in the group and via private message — were fascinating. For instance, Angela wrote:

Both of my parents worked as bankers when they were younger, so they talked openly about money when I was growing up and checked in with each other regularly regarding finances. I didn't realize how unusual that was until I was married and that was not the case with my husband and his family.

My dad was also self-employed, so they had to pay for many things out of pocket, like doctor's visits and dental. So my dad would barter for services. I grew up knowing that bartering is a possibility…

I really value the transparent attitude regarding money that they passed down to me.

Luke, too, learned the value of talking about money openly — but as a reaction to what his parents did not do:

My parents never talked openly about money, their situation, their goals. They both tried their hand at managing the house and both succeeded and failed in different ways, but it lead to a lot of fighting because they were never on the same page.

My wife and I are completely open and honest about how we spend, what are goals are, and how we will get there together. If I die tomorrow, she will know how to manage our money when I’m gone.

Rebecca's parents weren't transparent about money when she was younger. Now, though, they regret that.

I was raised that talking about money was in very poor taste. You never asked what people made, etc. That came from my dad's side of the family.

My mom didn't have much growing up and was very frugal (washing and reusing all the plastic wrap kind of thing). But my mom loves to “splurge” on things, so money was used to treat yourself, a definite reward system. I definitely fall into that trap, an engrained emotional response to treat myself.

My dad now says his biggest parenting mistake was to not to talk to us and educate us about money, saving and investing.

Some people come from families that had money and knew how to handle it. For example, Stephen's grandparents retired early back before the FIRE movement was a even a thing:

I only recently put two and two together and realized that my grandparents on my dad's side saved aggressively – invested the savings – and retired early – the early version of FIRE…

They influenced me greatly with their wisdom. I was advised by my grandmother that when it came to my diet, I should consider everything in moderation including moderation. My grandfather advised me to never carry debt, and if I had any to pay it off as soon as possible which I tried to follow, and my grandfather would often have BBC current affair programs on which I would watch with him.

But you don't have to be raised with money to learn good habits. Laronda's parents were poor but still set a good example.

My mom grew up dirt-poor as the twelfth of thirteen children in Appalachia. I learned to be resourceful from her. She can up-cycle, mend, and re-purpose with the best of them. She's a wonderful from-scratch cook and is able to turn inexpensive ingredients into tasty dinners. (I'm feeding my own family her stewed beans and cornbread this evening.)

My dad grew up slightly better off but I don't get the impression his family discussed finances much. He taught my brothers and I how to do basic home and auto repairs and gave me an outfitted tool box when I left home.

Growing up, we never discussed money or how to manage it. My brothers and I knew money was a tense, to-be-generally-avoided topic, and we knew not to ask for things.

I've graduated to the middle class and use many of my parents' frugal methods like scratch-cooking, mending and DIY home repairs, but I consciously choose to talk about money frequently with my own spouse and with my three children. I'm hoping my kids are better equipped with money management knowledge and skills when they strike out on their own than I was, but I also hope they benefit from their grandparents' gifts of resourcefulness and general competence in the face of any household challenge.

Finally, here's a story from a reader named Frank:

Neither of my parents had any real financial literacy. My grandmother was my real parent, and she taught me everything I know about money.

As a child, she escaped a war-torn country. She got married. She and her husband had a farm, but he killed himself after all of their chickens died. My grandmother was left to raise two kids alone.

Somehow, she scraped together enough to buy a hotel. She sold it and built a bigger hotel. She sold that and split the money with with my mother. But mom spent it all because she didn't appreciate the work and investment that had gone into building the fortune. Meanwhile, my grandmother quadrupled her half of the wealth.

I'm terrified to be my parents. I've tried to learn from my grandmother. The best thing she taught me was to live well below my means. I'm doing that and busting my ass to make my money grow.

Other members of the Get Rich Slowly FB group pointed me to longer articles they've written about this subject. At Choose FI, Chad shared what his parents taught him about financial independence. Fritz Gilbert from Retirement Manifesto has written about 18 lessons he learned from his dad. And Frogdancer Jones' parents taught her to approach retirement from a position of strength.

Final Thoughts

Although I can't recall having read any academic studies on the subject, I'm convinced that we do inherit money blueprints from our financial family tree. Your basic money habits are a product of what you learned from your parents and grandparents.

In some cases, these blueprints are a reaction against how your family behaved. Most of the time, however, you mimic what you saw when you were young.

The good news is that you're not doomed follow in your family's footsteps. Although these money scripts are deeply-ingrained and will always linger in the back of your mind, you have the knowledge and ability to create better habits, to draw a new, improved money blueprint.

From experience, I can tell you that the transformation takes time. It won't happen overnight. But with enough patience and effort, you can change your frame of mind. You can become a money boss and produce a new branch on your financial family tree.

The post Your financial family tree: What our parents teach us about money appeared first on Get Rich Slowly.